(Immediate Donation Transfer – Transaction Fees are Deducted)

(Donations Transferred Monthly – No Transaction Fees)

$470 – $938 Arizona Tax Credit is available until 2024 tax-filing-day (April 15, 2025)!

Arizona Tax Credit

Arizona Tax Credit

Arizona Tax Credits (amounts vary) are available each year for Donations to Qualifying Charitable Organizations, Foster Care, Private Schools and Public Schools. Taxpayers may use several Tax Credits each year. A Donation made anytime during the tax year… or as late as Tax-Filing-Day… is deducted directly from your Arizona State Tax liability.

For Donations to Qualifying Charitable Organizations in 2023, a maximum Tax Credit of $421 is available to individual filers. A maximum Tax Credit of $841 is available to joint filers. Arizona law allows QCO donations made during 2023 or donations made from January 1, 2024 through April 15, 2024 to be claimed on the 2023 Arizona income tax return. The Tax Credit cannot exceed the tax liability. If a taxpayer makes a QCO donation from January 1, 2024 through April 15, 2024 and wants to claim the higher 2024 maximum credit amount, the taxpayer will need to claim the credit on the 2024 Arizona return filed in 2025.

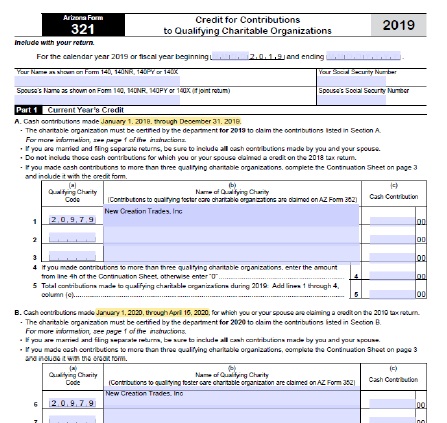

No need to itemize deductions! Just complete Form 321 – ‘Credit for Contributions to Qualifying Charitable Organizations’. Enter ‘New Creation Trades, Inc.’ in the form. Your Donation can be deducted directly from your tax liability.

New Creation Trades is an Arizona 501(c)(3) Corporation which is certified as a Qualifying Charitable Organization.

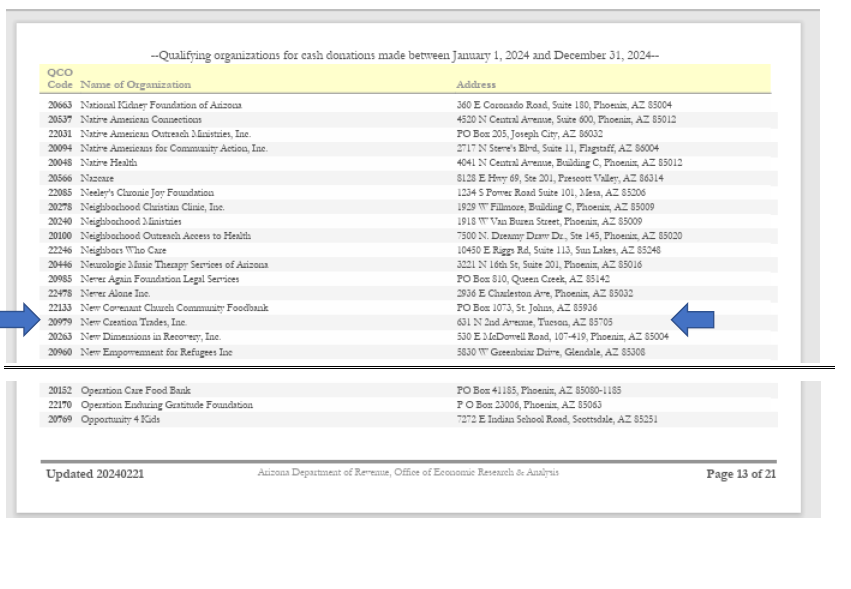

To verify New Creation Trades, Inc. Qualifying Status, go to:

-

- CREDITS_2024_qco.pdf (azdor.gov)

- Click the ‘QCO’ box for the tax year.

- Locate New Creation Trades, Inc. in the alphabetical list of organizations:

https://azdor.gov/sites/default/files/2024-01/CREDITS_2024_qco.pdf

Claim Tax Credit on AZ Form 321

Donors are required to use the QCO Code when taking the TAX CREDIT on their AZ Tax Returns.

- New Creation Trades. Inc QCO Code is: 20979

- Download AZ Form 321 & Instructions

- Enter QCO Code ‘20979’ On Form 321

- Please Note Highlighted areas in the Sample Form 321:

Sample: AZ Form 321

Federal Income Tax credit

Federal Income Tax credit

New Creation Trades, Inc is an Arizona 501(c)(3) Corporation certified by the IRS as eligible to receive tax-deductible charitable contributions: IRS EIN 81-4425679. Donations completed by December 31st can be included as ‘Charitable Contributions’ in ‘Itemized Deductions’ in your annual Tax Return for the year ending December 31st. Tax-Exempt status began with the year 2016… and thereafter.

New creation Trades, Inc. operates under the umbrella/oversight of Community Renewal, Inc. For this reason, New Creation Trades is not listed directly when entering the EIN in the ‘IRS Eligible Charity’ Search Tool available at Search for Tax Exempt Organizations | Internal Revenue Service (irs.gov) It is necessary to call the IRS at the number listed below:

New Creation Trades is an Arizona 501(c)(3) Corporation which is certified as a Qualifying Charitable Organization.

To Verify New Creation Trades, Inc. ‘IRS Eligible Charity Status’:

-

- CALL the IRS at (887) 829-5500

- PROVIDE New Creation Trades Inc – IRS EIN: 81-4425679

- PROVIDE ‘Community Renewal Inc’. – Umbrella IRS EIN: 01-0872301, Group Exemption 5600